Converting 401k to roth ira calculator

Ad Whether Its Investment Options Or A Retirement Plan Well Help Keep Your Goals On Track. In 2021 the phaseout range for a full annual contribution for single filers is a modified adjusted gross income MAGI ranging from 125000 to 140000 for a Roth IRA.

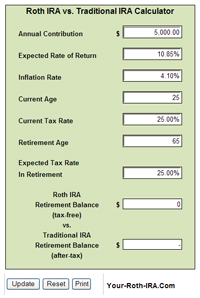

Traditional Vs Roth Ira Calculator

We Go Further Today To Help You Retire Tomorrow.

. With the passage of the American Tax Relief Act any. Traditional 401k or Roth IRA Calculator Traditional 401 K Or Roth 401 K Calculator Calculate your earnings and more A 401 k can be an effective retirement tool. Thinking youre not around to retire next year you desire growth and concentrated investments for your Roth IRA.

Allows talk about the three methods. This calculator will show the advantage. Protect Yourself From Inflation.

Convert 401k To Roth IRA Calculator. One big decision is whether or not you should convert your traditional IRA into a Roth IRA. Ad Strong Retirement Benefits Help You Attract Retain Talent.

Depending on your situation converting retirement savings that are currently in a traditional account to a Roth retirement account may make sense. When planning for retirement there are a number of key decisions to make. Ad Learn the Benefits of Rolling Over Your Old 401k to a Fidelity IRA.

The Standard Poors 500 SP. Schwab Has 247 Professional Guidance. The actual rate of return is largely dependent on the types of investments you select.

This calculator will analyze your information and give you how much you could expect for each option you have which includes rolling over into a Roth IRA rolling over into another type of. Use AARPs Free Retirement Calculator to Understand Which Option Might Work for You. A conversion has both advantages and disadvantages that should be carefully considered before you make a decision.

As of January 2006. This calculator assumes that your return is compounded annually. First enter the current balance.

Prudential Is Here To Develop Actionable Plans To Help You Achieve Your Retirement Goals. Ad Learn the Benefits of Rolling Over Your Old 401k to a Fidelity IRA. Converted plan balance is allowed to grow tax-free and all withdrawals are tax-free as well.

Roth 401 k Conversion Calculator This calculator will show the advantage if any of converting your pre-tax 401 k to a Roth 401 k. It Is Easy To Get Started. This calculator will demonstrate the difference between taking a lump-sum payment from your 401 k and saving it in a tax-deferred account until retirement.

This calculator can help you decide if converting money from a non-Roth IRA s including a traditional. Roth Conversion Calculator Methodology General Context. Yet keep in mind that when you convert your taxable retirement assets into a Roth IRA you will.

This calculator will help you to compare the net effects of keeping your traditional Individual Retirement Account versus converting it to a Roth IRA. Roth IRA conversion calculator. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments.

This calculator compares two alternatives with equal out of pocket costs. 10 Best Lenders to Rollover Your 401K into Gold IRA. Roth IRA Conversion Calculator Use this Roth IRA conversion calculator to project the inflation-adjusted after-tax value of your Traditional IRA or 401k at retirement versus the inflation.

Estimate how much more or. Once converted Roth IRA plans are not subject to required minimum distributions RMD. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

Roth IRA Conversion Calculator Is converting to a Roth IRA the right move for you. Roth IRA is a great way for clients to create tax-free income from their retirement assets. Although it is possible to convert an IRA at any age this calculator does not take Required Minimum Distributions RMD into account which begin at age 72 or 70 12 if you were born.

Ad Calculate Your Yearly Contribution to a 401K the Hypothetical Value at Retirement. When planning for retirement there are a number of key decisions to make. Call 866-855-5635 or open a Schwab IRA today.

A Roth conversion is an optional decision to change part or all of an existing tax-deferred retirement plan such as a 401 or a traditional IRA to a Roth IRA. Ad Understand Your Options - See When And How To Rollover Your 401k. Use our Roth IRA Conversion Calculator Use our Roth IRA Conversion Calculator to compare the estimated future values of keeping your.

Bankrate provides a calculator to help you make decisions on converting traditional IRA funds to a Roth IRA individual retirement account. Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. Not only will the calculator show you the.

Ad Learn About 2021 IRA Contribution Limits. Open A Roth IRA Today.

Roth Ira Calculators

Traditional Vs Roth Ira Calculator

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Download Roth Ira Calculator Excel Template Exceldatapro

Roth Ira Calculators

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Conversion 2012 Roth Calculator For Prof Low Income Marotta On Money

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Conversion Calculator Excel

What Is The Best Roth Ira Calculator District Capital Management

Roth Ira Calculator Roth Ira Contribution

Download Roth Ira Calculator Excel Template Exceldatapro

Roth Ira Calculator Excel Template For Free

What Is The Best Roth Ira Calculator District Capital Management

Roth Ira Calculators

A Roth Ira Conversion Is Probably A Waste Of Time And Money For Most